Burn Rate

What is Burn Rate?

Definition:

“Burn Rate” in the realm of business and finance refers to the rate at which a company uses up its cash or financial resources, typically on a monthly basis. It represents the net negative cash flow and indicates how quickly a company is spending its available capital to cover operational expenses. Monitoring burn rate is crucial for startups and businesses to assess their financial health and sustainability.

Analogy:

Think of Burn Rate as the speed at which a car consumes fuel. Just as the burn rate of fuel determines how long a car can operate before needing to refuel, a company’s burn rate indicates how long it can sustain its operations before requiring additional funding or achieving profitability.

Further Description:

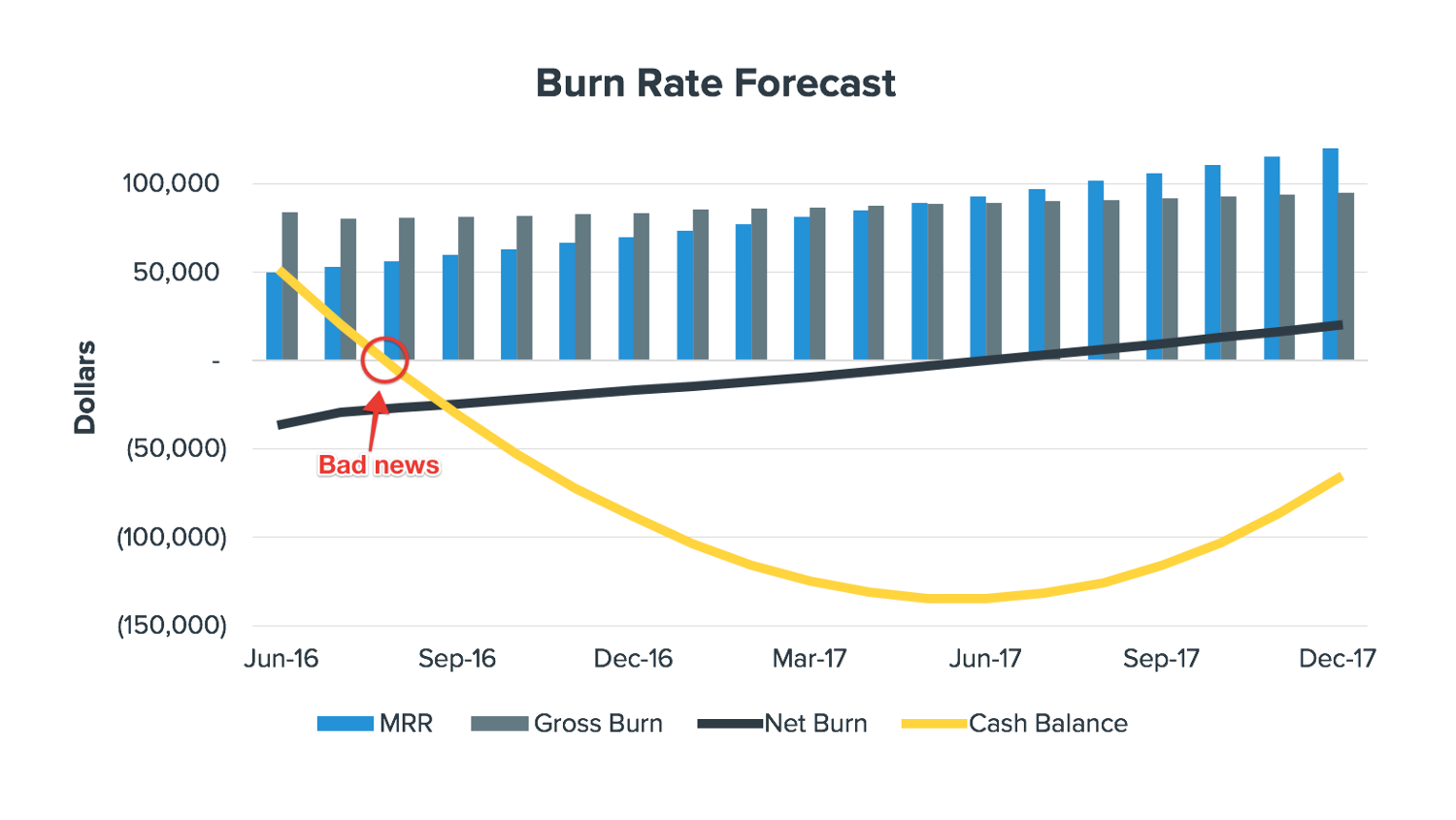

Burn Rate is calculated by subtracting the total monthly expenses from the total monthly revenue, resulting in the net cash flow. A high burn rate implies that a company is spending money quickly, while a low burn rate suggests more conservative spending. Startups often have higher burn rates as they invest heavily in growth, with the expectation of achieving profitability in the future.

Why is Burn Rate Important?

Burn Rate is a crucial metric for assessing the financial viability and runway of a company. It helps stakeholders, including investors and management, understand how long a company can continue its operations before needing additional funding. Monitoring burn rate is essential for strategic planning, budgeting, and making informed decisions about fundraising or adjusting operational expenses.

Examples and Usage:

Startup Funding: Investors evaluate a startup’s burn rate to understand how quickly it is using the funds raised and estimate the time until the company becomes profitable.

Financial Health Assessment: Companies regularly analyze their burn rate to assess financial health, adjust spending, and plan for sustainable growth.

Runway Calculation: Burn rate is used to calculate the runway, representing the time a company has until it runs out of cash, considering its current spending and available funds.

Investor Communication: Startups communicate their burn rate to investors, providing transparency about financial performance and the need for additional funding.

Basically, Burn Rate is a financial metric that indicates the rate at which a company is using its available capital to cover operational expenses. It is crucial for assessing financial sustainability and planning for future funding needs.

For example, a startup with a high burn rate may need to secure additional funding to extend its runway and continue operations until it reaches profitability.

Key Takeaways:

- Burn Rate is the rate at which a company uses up its cash or financial resources, typically on a monthly basis.

- It indicates how quickly a company is spending its available capital to cover operational expenses.

- Monitoring the burn rate is crucial for assessing financial health, planning for sustainable growth, and making informed decisions about fundraising.

- Examples include evaluating burn rates for startup funding, assessing financial health, calculating runway, and communicating with investors.