Cap Table Management

What is Cap Table Management?

Definition:

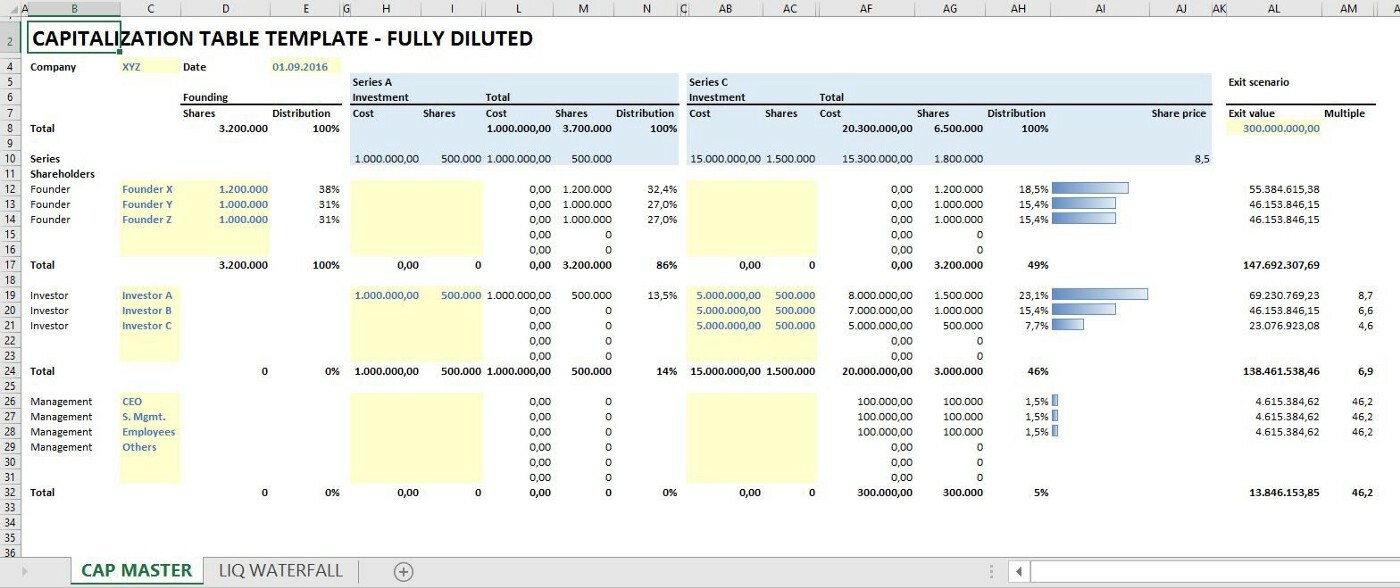

“Cap Table Management” in the realm of finance and startup management refers to the process of effectively managing and maintaining the company’s capitalization table (cap table). A cap table is a detailed ledger that outlines the ownership structure of a company, including information about equity ownership, equity types, and the stakeholders involved. Cap table management involves tracking and updating this information, especially as ownership changes occur due to fundraising, employee stock options, or other equity-related transactions.

Analogy:

Think of Cap Table Management as the financial blueprint of a building. Just as a blueprint details the ownership and structure of different sections of a building, a cap table serves as the financial blueprint of a company, providing a comprehensive view of its ownership and equity distribution.

Further Description:

Cap Table Management includes recording and updating details such as the names of shareholders, the types of securities they hold (common stock, preferred stock, options, etc.), and the percentage of ownership each party possesses. Changes to the cap table occur during funding rounds, employee stock grants, or any events that impact ownership structure. Cap table management tools and software streamline this process, ensuring accuracy, transparency, and compliance with regulatory requirements.

Why is Cap Table Management Important?

Cap Table Management is crucial for startups and businesses seeking transparency in ownership and equity distribution. It provides a clear picture of the company’s financial health, facilitates decision-making during fundraising, and ensures compliance with legal and regulatory obligations. Effective cap table management helps in understanding the dilution impact of new investments and maintaining healthy relationships with investors and stakeholders.

Examples and Usage:

Funding Rounds: Cap table management tools are utilized during funding rounds to track new investments, issue new shares, and update ownership percentages.

Employee Stock Options: When granting stock options to employees, cap table management involves recording these transactions and adjusting the ownership structure accordingly.

Convertible Note Conversions: Cap table management is crucial when convertible notes convert into equity, as it impacts the distribution of ownership among existing shareholders and new investors.

Mergers and Acquisitions: In the event of mergers or acquisitions, cap table management helps in updating ownership details and reflecting changes resulting from the transaction.

Basically, Cap Table Management involves the organized tracking and updating of a company’s cap table, providing a clear overview of its ownership and equity distribution.

For example, a startup might use cap table management tools to accurately record and manage equity transactions, ensuring transparency and compliance with regulatory requirements.

Key Takeaways:

- Cap Table Management involves effectively tracking and maintaining a company’s capitalization table (cap table).

- A cap table details the ownership structure, equity types, and stakeholders involved in a company.

- It is crucial for transparency, decision-making during fundraising, and compliance with legal and regulatory obligations.

- Examples include cap table management during funding rounds, employee stock options, convertible note conversions, and mergers/acquisitions.