Cost of Goods Sold (COGS)

What is Cost of Goods Sold (COGS)?

Definition:

“Cost of Goods Sold” (COGS) is a critical accounting metric that represents the direct costs incurred in producing or purchasing the goods that a company sells during a specific period. Also known as “cost of sales” or “cost of revenue,” COGS includes various expenses directly associated with the production of goods, such as raw materials, labor, and manufacturing overhead. Calculating COGS is essential for determining a company’s gross profit, understanding profitability, and evaluating the efficiency of its production processes.

Analogy:

Think of Cost of Goods Sold as the ingredients cost in a restaurant. Just as the cost of ingredients is a direct expense in providing meals, COGS accounts for the direct expenses incurred in creating the products a company sells.

Further Description:

COGS includes direct costs tied to the production of goods and can encompass:

Raw Materials: The cost of the materials directly used in the manufacturing process.

Direct Labor: The wages and benefits paid to employees directly involved in the production of goods.

Manufacturing Overhead: Indirect costs related to production, such as utilities, maintenance, and depreciation of manufacturing equipment.

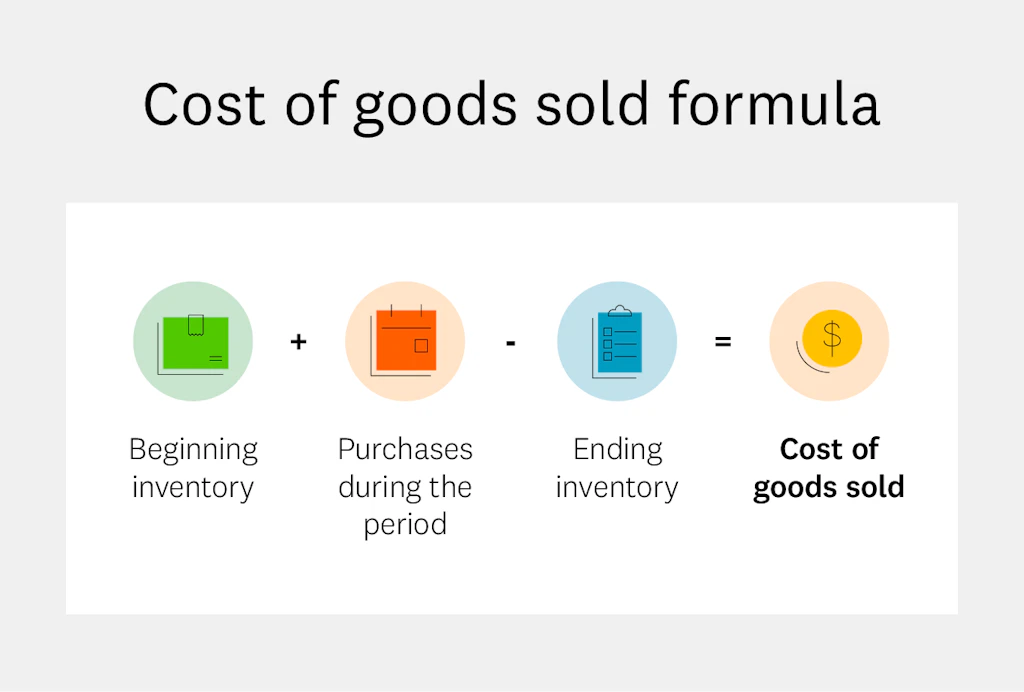

The formula for calculating COGS is:

COGS=Opening Inventory+Purchases or Production Costs?Closing Inventory

Why is Cost of Goods Sold Important?

COGS is crucial for several reasons:

Gross Profit Calculation: COGS is subtracted from total revenue to calculate gross profit, providing insights into the direct profitability of the core business operations.

Profitability Analysis: Understanding the costs directly associated with producing goods helps in evaluating the overall profitability of products and making informed pricing decisions.

Financial Reporting: COGS is a key component in the income statement, providing transparency in financial reporting and aiding in the analysis of operational efficiency.

Tax Deductions: In some jurisdictions, COGS is a deductible expense, impacting a company’s taxable income.

Examples and Usage:

Manufacturing Company: For a company manufacturing smartphones, COGS includes the cost of materials, labor involved in assembling the phones, and the overhead costs of the manufacturing facility.

Retailer: For a clothing retailer, COGS comprises the wholesale cost of the clothes purchased from suppliers, along with any direct costs tied to alterations or customization.

Restaurant: In a restaurant, COGS includes the cost of ingredients used in preparing dishes, as well as the direct labor costs of kitchen staff.

Basically, Cost of Goods Sold represents the direct costs incurred in producing or purchasing the goods that a company sells. It is a fundamental metric for assessing profitability and operational efficiency.

For example, a software company might consider the cost of developing its software products, including the salaries of programmers and the overhead associated with software development, when calculating COGS.

Key Takeaways:

- Cost of Goods Sold (COGS) is the direct cost associated with producing or purchasing the goods that a company sells.

- It includes expenses such as raw materials, direct labor, and manufacturing overhead.

- COGS is crucial for calculating gross profit, analyzing profitability, and making informed pricing decisions.

- Examples include manufacturing smartphones, retailing clothing, and running a restaurant.

Table of Contents