Equity

What is Equity?

Definition:

“Equity” in the financial and business context refers to the ownership interest or residual interest in an asset after deducting liabilities. It represents the shareholders’ claim on the company’s assets and earnings, indicating the portion of ownership held by individuals or entities. Equity is a fundamental concept in accounting and finance, commonly associated with stocks in publicly traded companies.

Analogy:

Think of Equity as a slice of the pie. Just as each slice represents a portion of the whole pie, equity represents an ownership share in a company, indicating the claim a shareholder has on the company’s assets and profits.

Further Description:

Types of Equity:

- Common Stock: The most basic form of equity, representing ownership and voting rights in a company.

- Preferred Stock: Carries certain privileges over common stock, such as priority in receiving dividends.

- Retained Earnings: Profits that a company keeps rather than distributing as dividends, contributing to shareholders’ equity.

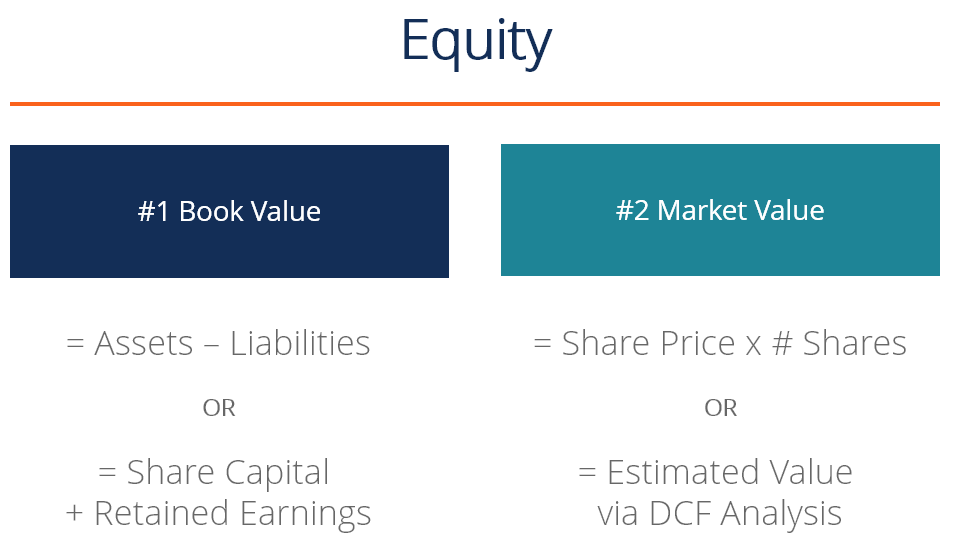

Equity on the Balance Sheet:

- Shareholders’ Equity Section: Found on a company’s balance sheet, it includes common stock, preferred stock, additional paid-in capital, and retained earnings.

- Book Value: Represents the shareholders’ equity on a per-share basis and is calculated by dividing total equity by the number of outstanding shares.

Equity Financing:

- IPOs (Initial Public Offerings): Companies raise capital by issuing shares to the public, diluting existing equity but providing funds for expansion.

- Private Equity: Investments from private individuals or institutions in exchange for ownership in a non-publicly traded company.

Why is Equity Important?

- Ownership Representation: Equity signifies ownership in a company, enabling shareholders to participate in decision-making through voting rights.

- Financial Health: Shareholders’ equity on the balance sheet reflects a company’s financial health and its ability to meet obligations.

- Investor Value: Equity represents the portion of a company’s value attributable to its shareholders, and changes in equity impact a company’s market capitalization.

Examples and Usage:

- Publicly Traded Companies: Investors can buy and sell shares in the stock market, gaining ownership (equity) in companies like Apple, Microsoft, or Google.

- Startup Equity: Employees and investors may receive equity in the form of stock options or shares in a startup, aligning their interests with the company’s success.

- Real Estate Equity: In real estate, equity is the value of the property minus any outstanding mortgage or loans secured by the property.

- Private Company Ownership: Owners and investors in private companies hold equity, representing their proportional ownership stake.

In summary, Equity is a crucial financial concept representing ownership in a company, commonly associated with stocks. It serves as a measure of ownership interest and financial health.

Key Takeaways:

- Equity represents ownership interest in a company, indicating the claim shareholders have on its assets and earnings.

- Types of equity include common stock, preferred stock, and retained earnings.

- Equity is crucial for ownership representation, financial health assessment, and determining a company’s value.

- Equity can be traded on the stock market, granted to employees in startups, and represents ownership in various assets.