Growth Capital

What is Growth Capital?

Definition:

Growth Capital refers to the funding provided to businesses with the specific purpose of fueling expansion, whether it be through increased production capacity, market expansion, product development, or other strategic initiatives. Unlike traditional financing that focuses on day-to-day operations, growth capital is tailored to support companies in scaling their operations and reaching new heights.

Analogy:

Think of growth capital as the financial nutrients needed for a plant to grow taller and spread its roots. In the business context, growth capital provides the necessary resources for a company to expand its operations, enter new markets, and achieve sustainable growth.

Further Description:

Growth capital encompasses various financial instruments and investment strategies:

Strategic Planning: Like content strategy development, growth capital involves strategic planning. Businesses must outline clear objectives and a roadmap for expansion, identifying key areas where additional capital can drive growth.

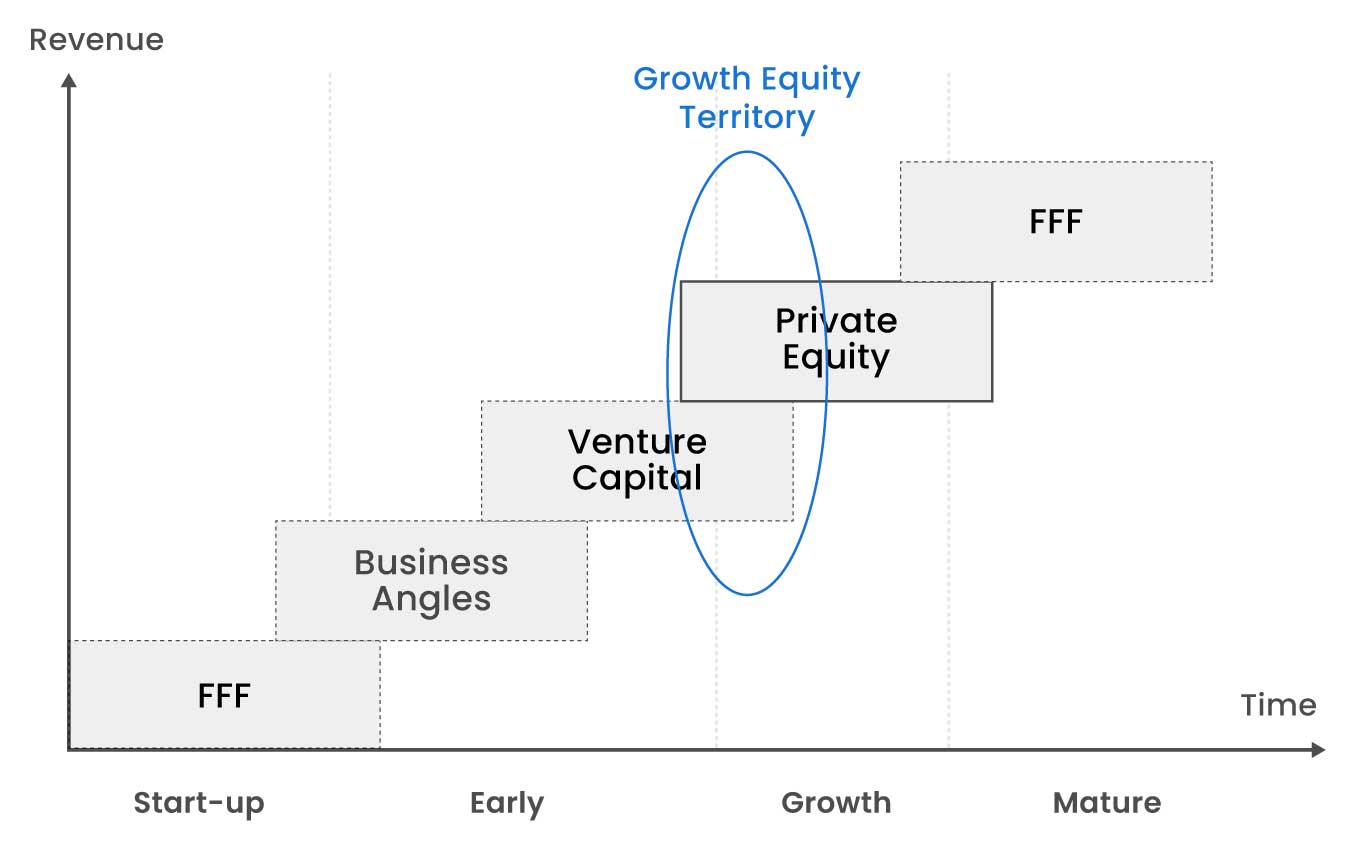

Investment Vehicles: Growth capital can be injected through various investment vehicles, including equity investments, venture capital, private equity, and sometimes convertible debt. The choice depends on the business’s stage, industry, and growth plans.

Market Research: Just as audience research is crucial in content strategy, growth capital decisions often involve in-depth market research. Understanding market trends, consumer behavior, and competitive landscapes is vital for informed investment decisions.

Risk Assessment: Assessing risks is a parallel step in both content strategy and growth capital. Businesses must identify and mitigate potential risks associated with expansion plans to ensure a successful growth trajectory.

Financial Metrics: Like measuring performance in content strategy, growth capital requires defining financial metrics to track the impact of the investment. Metrics may include revenue growth, market share expansion, and return on investment (ROI).

Why is Growth Capital Important?

Fueling Expansion: Growth capital provides the necessary financial resources to fuel a company’s expansion, enabling it to take advantage of new opportunities and markets.

Competitive Edge: Businesses infused with growth capital can stay ahead of competitors by investing in innovation, technology, and strategic initiatives that enhance their competitive position.

Job Creation: Expansion often leads to increased employment opportunities, contributing to economic development and job creation in the regions where businesses operate.

Scaling Operations: Growth capital allows businesses to scale their operations efficiently, whether through increased production capacity, geographic expansion, or the development of new products and services.

Attracting Talent: Well-funded companies are better positioned to attract top talent. Growth capital can be used to invest in human capital, fostering a skilled and motivated workforce.

Examples and Usage:

Tesla: Tesla’s growth capital journey involved significant investments to scale its electric vehicle production, expand its Gigafactories, and enter new markets globally.

Uber: Uber’s rapid expansion into various countries and the development of new services were supported by substantial growth capital investments, including venture capital and private equity funding.

Tech Startups: Many technology startups secure growth capital from venture capitalists to fund research and development, scale their platforms, and gain a foothold in competitive markets.

Key Takeaways:

- Growth capital requires a well-defined strategic plan for expansion, outlining clear objectives and a roadmap.

- Various investment vehicles, such as equity investments and venture capital, can be utilized for injecting growth capital.

- In-depth market research is crucial to understanding trends, consumer behavior, and competitive landscapes before making growth capital decisions.

- Businesses must assess and mitigate potential risks associated with expansion plans to ensure a successful growth trajectory.

- Defining and tracking key financial metrics, such as revenue growth and ROI, is essential for measuring the impact of growth capital investments.