Liquidation Preference

What is Liquidation Preference?

Definition:

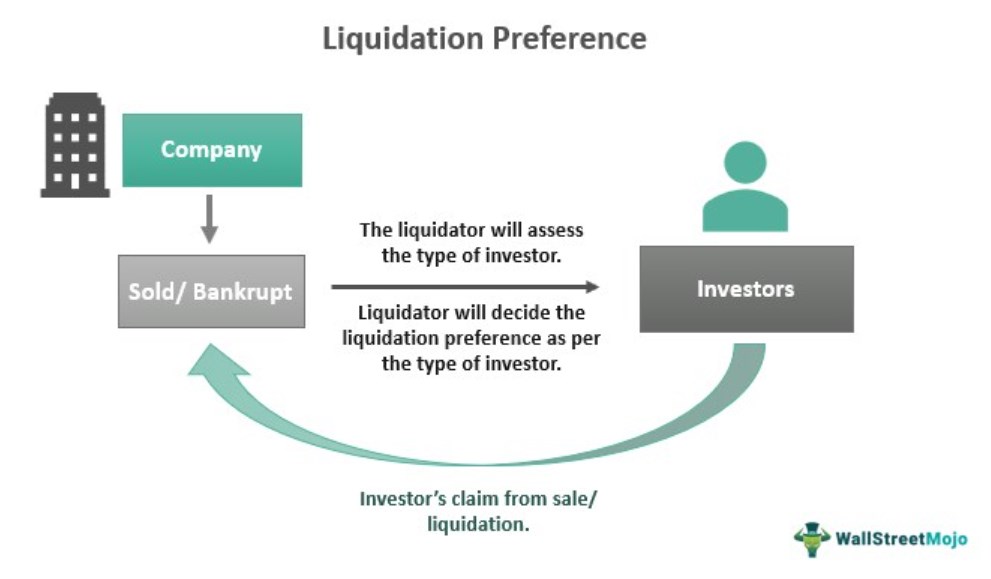

Liquidation Preference refers to a provision in an investment agreement, typically associated with venture capital financing, that outlines the order in which investors receive payouts in the event of a company’s liquidation or exit. This provision ensures that certain investors, often preferred stockholders, have the right to receive a specified amount of proceeds before common stockholders receive any distribution. Liquidation preference is a protective mechanism for investors to safeguard their investment and mitigate risks in the case of a company’s failure or sale.

Analogy:

Consider liquidation preference as a safety net for investors, similar to insurance for a valuable possession. Just as insurance guarantees compensation in the event of damage or loss, liquidation preference protects investors by securing their claim on assets in case the company faces financial challenges or undergoes a liquidation event.

Further Description:

Liquidation preference involves several key components:

Preferred Stock: Typically, the provision applies to preferred stockholders who, in the event of liquidation, have the right to receive a predetermined amount of the remaining assets before common stockholders.

Fixed or Participating: Liquidation preference can be either fixed or participating. A fixed liquidation preference guarantees a specific amount to preferred stockholders, while participating allows them to receive additional proceeds after the fixed amount before common stockholders participate.

Multiple of Investment: Liquidation preference is often expressed as a multiple of the original investment. For example, a 1x liquidation preference means the investor receives an amount equal to their initial investment before others, while a 2x preference would be twice the initial investment.

Impact on Valuation: Liquidation preference can influence the valuation of a company, especially in later financing rounds. Investors may negotiate for higher preferences to mitigate risks, affecting the overall valuation of the business.

Conversion Rights: Preferred stockholders may have the option to convert their preferred shares into common shares, relinquishing their liquidation preference in exchange for ownership equity.

Why is Liquidation Preference Important?

Investor Protection: Liquidation preference protects investors by ensuring they recoup a certain portion of their investment before other stakeholders in the event of a liquidation or sale.

Risk Mitigation: Investors face risks in startup and high-growth environments. Liquidation preference helps mitigate these risks by providing a level of financial protection.

Attracting Investment: Including a reasonable liquidation preference can make an investment opportunity more attractive to investors, encouraging capital infusion into the company.

Negotiating Tool: Liquidation preference is a negotiating point during funding rounds. Companies and investors engage in discussions to determine the terms that balance investor protection and the company’s growth potential.

Examples and Usage:

Preferred Stock Agreement: In a venture capital deal, investors may negotiate a 1x liquidation preference, ensuring that, in the event of liquidation, they receive at least the amount of their initial investment before common stockholders.

Impact on Valuation: If a company agrees to a higher liquidation preference, it may result in a lower valuation, as investors are seeking additional protection for their investment.

Key Takeaways:

Investor Safeguard: Liquidation preference safeguards investors by ensuring they receive a specified amount of proceeds before other stakeholders in the event of a company’s liquidation.

Variable Structures: Liquidation preference can have variable structures, such as fixed or participating, and may be expressed as a multiple of the original investment.

Negotiation Point: Liquidation preference is a key negotiation point in investment agreements, influencing the terms of the deal and impacting the company’s valuation.

Investment Attraction: Including a fair and reasonable liquidation preference can make an investment opportunity more attractive to potential investors, facilitating capital infusion into the company.