Seed Capital

What is Seed Capital?

Definition:

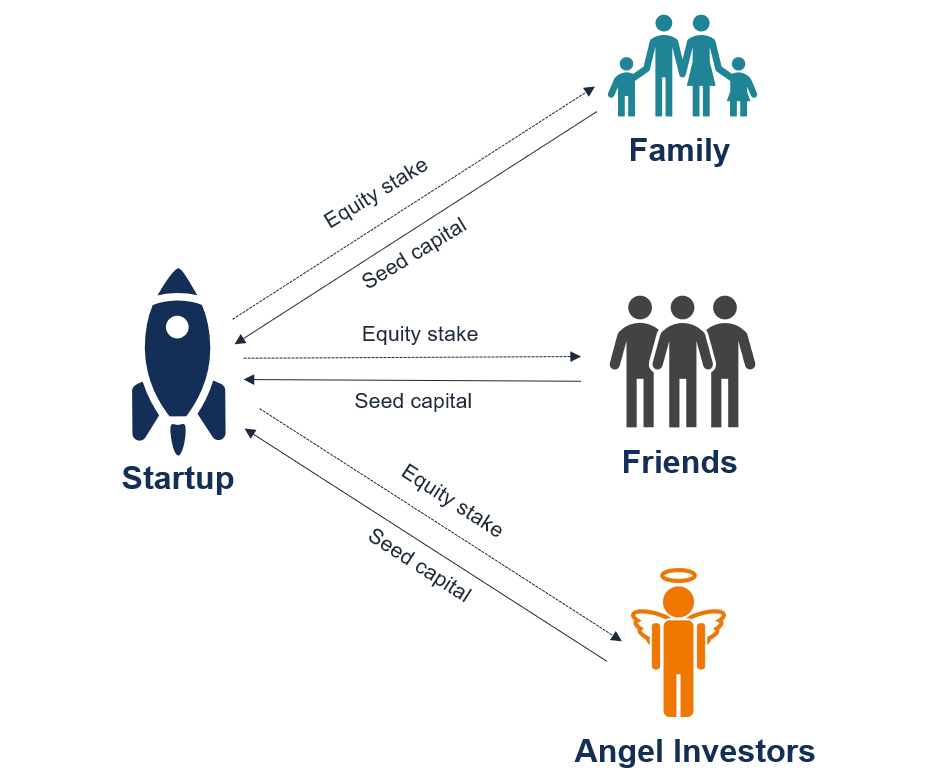

Seed Capital, often referred to as seed funding, is a type of initial investment provided to early-stage startups to help them establish and develop their business. It serves as the initial capital injection that supports a startup’s initial operations, product development, and market research. Seed capital is typically raised from angel investors, venture capitalists, or through crowdfunding platforms.

Analogy:

Think of seed capital as the financial soil that allows a startup to plant its idea and nurture its growth. Similar to how a seed needs resources to germinate and sprout into a plant, seed capital provides the essential financial support for a startup to take root, develop its product or service, and begin its journey toward sustainable growth.

Further Description:

Seed capital is crucial for startups during their infancy when they often lack a proven business model or significant revenue. The key aspects of seed capital include:

Product Development: Seed capital allows startups to invest in research and development, creating and refining their products or services.

Market Research: Startups can use seed funding to conduct market research, understand their target audience, and refine their business strategy based on market feedback.

Initial Operations: Seed capital covers essential operational costs such as hiring key team members, acquiring necessary resources, and establishing a physical or online presence.

Proof of Concept: Seed funding helps startups demonstrate the feasibility and viability of their business idea, making them more attractive to future investors.

Why is Seed Capital Important?

Risk Mitigation: For investors, providing seed capital involves higher risk due to the early stage of the startup. However, it also offers the potential for significant returns if the startup succeeds.

Startup Ecosystem Support: Seed capital plays a vital role in fostering innovation and entrepreneurship by supporting early-stage ventures that may struggle to secure traditional financing.

Catalyst for Growth: Seed funding acts as a catalyst, enabling startups to reach key milestones and position themselves for subsequent rounds of funding.

Examples and Usage:

Angel Investors: Individuals who invest their personal funds in startups, often providing seed capital in exchange for equity.

Venture Capital Firms: Some venture capital firms specialize in seed-stage investments, providing capital and mentorship to promising startups.

Crowdfunding Platforms: Startups can raise seed capital by presenting their ideas to a broader audience through online crowdfunding campaigns.

Key Takeaways:

- Seed capital is the initial funding provided to startups to support their early-stage development.

- It covers essential aspects such as product development, market research, and initial operations.

- Seed funding is crucial for mitigating risks, fostering innovation, and acting as a catalyst for startup growth.

- Examples of seed capital sources include angel investors, venture capital firms, and crowdfunding platforms.