Seed Capital Investment

What is Seed Capital Investment?

Definition:

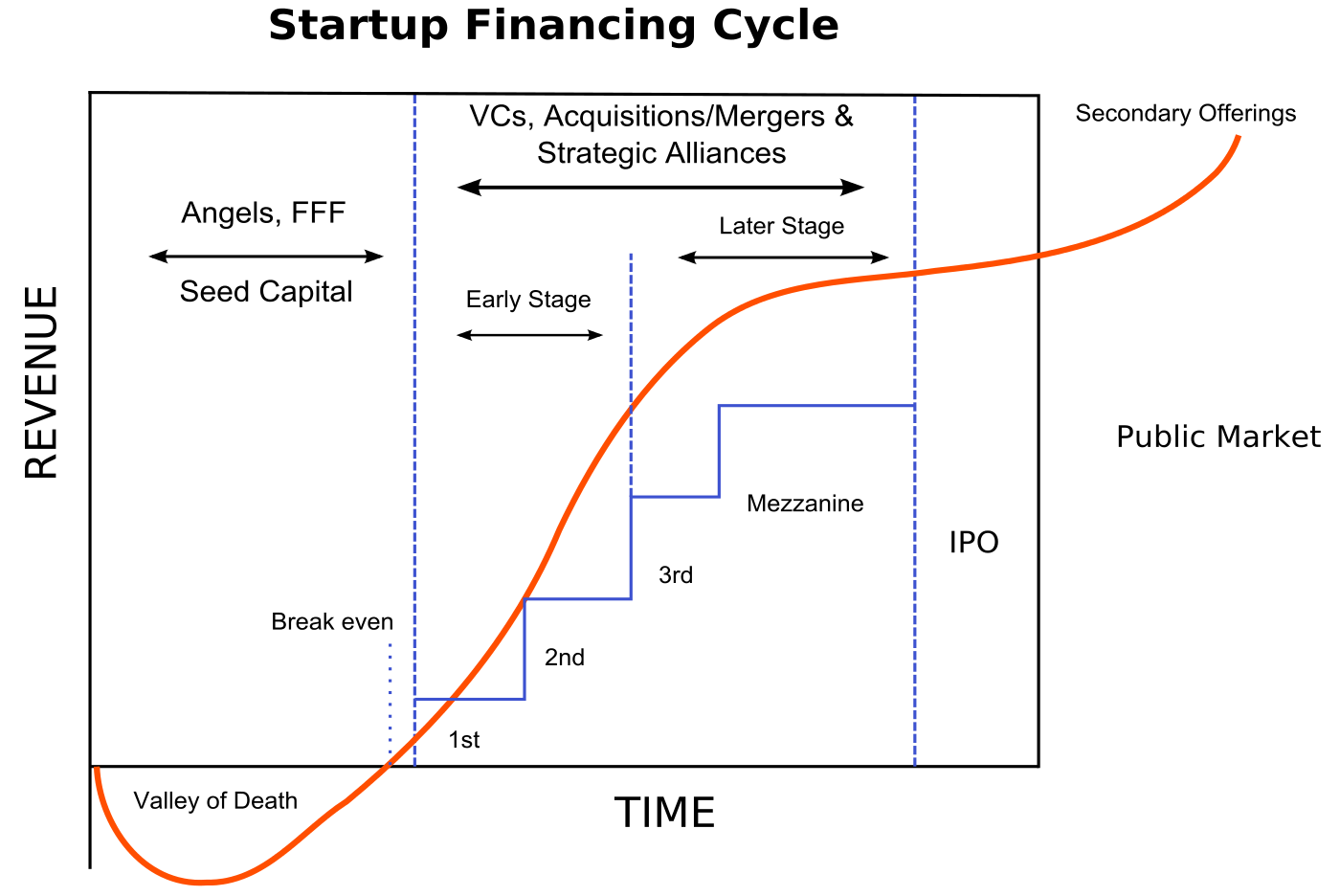

Seed capital investment refers to the initial funding provided to start-ups or early-stage companies to help them develop a viable product or service, conduct market research, and cover initial operating expenses. This type of investment is often considered the “seed” that enables a new venture to sprout and grow. Seed capital is typically provided by angel investors, venture capitalists, or other sources interested in supporting innovative ideas and businesses in their early stages.

Analogy:

Imagine seed capital investment as the nutrients and water needed to nurture a small seed into a thriving plant. In the business world, the seed capital serves as the essential resources that enable a budding company to take root, grow, and eventually attract more substantial funding as it matures.

Further Description:

Seed capital investments involve providing financial support to entrepreneurs and start-ups during their infancy. Key components of seed capital investment include:

Product Development: Seed funding supports the creation and refinement of a company’s product or service, helping it reach a stage where it becomes market-ready.

Market Research: Funding is allocated to conduct market research, enabling the company to understand its target audience, competition, and potential challenges.

Operating Expenses: Seed capital covers initial operating costs such as rent, salaries, utilities, and other overhead expenses necessary to get the business off the ground.

Prototype or Minimum Viable Product (MVP): Seed funding allows the development of prototypes or MVPs, which are crucial in showcasing the viability of the business to future investors.

Why is Seed Capital Investment Important?

Catalyst for Growth: Seed capital provides the initial impetus for start-ups to develop their ideas into tangible products or services, paving the way for future growth.

Risk Mitigation: Investors providing seed capital understand the high-risk nature of early-stage ventures and play a crucial role in mitigating that risk by supporting promising ideas.

Innovation Stimulus: Seed capital encourages innovation by enabling entrepreneurs to explore new concepts and bring inventive solutions to market, contributing to overall industry advancement.

Attracting Follow-on Funding: Successful utilization of seed capital enhances a start-up’s credibility, making it more appealing to later-stage investors and increasing the likelihood of securing additional funding rounds.

Examples and Usage:

Angel Investors: Individuals who provide seed capital in exchange for equity or convertible debt, often bringing not only financial support but also mentorship and industry expertise.

Venture Capital (VC) Firms: Some venture capital firms focus on providing seed funding to promising start-ups, recognizing the potential for substantial returns as the companies grow.

Crowdfunding Platforms: Online platforms allow entrepreneurs to raise seed capital from a large number of individuals interested in supporting innovative projects.

Key Takeaways:

- Seed capital investment involves providing initial funding to start-ups for product development, market research, and operating expenses.

- It is often provided by angel investors, venture capitalists, or crowdfunding platforms.

- Seed capital serves as a catalyst for growth, helps mitigate risk, stimulates innovation, and enhances a start-up’s ability to attract follow-on funding.