Series A, B, C Funding

What is Series A, B, C Funding?

Definition:

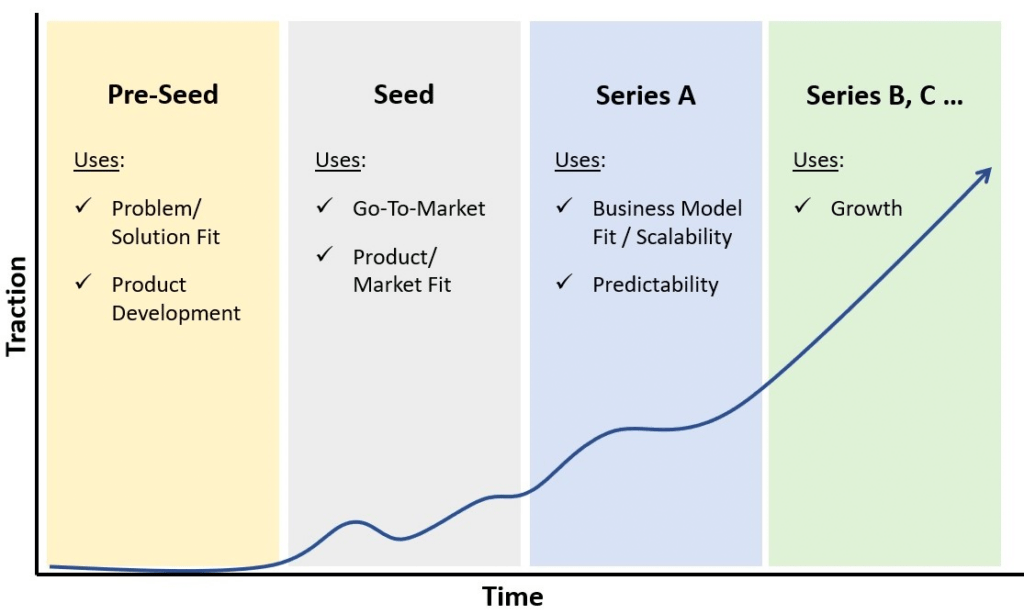

Series A, B, and C funding are stages of investment in a startup or emerging company, representing different rounds of financing as the business progresses. Each funding round corresponds to a specific phase of growth and development, allowing the company to secure capital for various purposes, such as expanding operations, product development, and market expansion.

Analogy:

Consider Series A, B, and C funding as milestones in a road trip. Series A is like fueling up the car for the initial journey, Series B is stopping for maintenance and upgrades along the way, and Series C is gearing up for a faster and more ambitious drive with additional resources and support.

Further Description:

Series A Funding: Series A funding typically follows the initial seed funding. It focuses on scaling the business after proving the concept. Investors in this round are often venture capitalists and institutional investors. The funds from Series A are commonly used for expanding the team, further developing the product or service, and establishing a stronger market presence.

Series B Funding: Series B comes into play when a startup has demonstrated viability in the market and seeks additional capital for substantial growth. Investors expect the company to have achieved certain milestones. This round is often dedicated to scaling operations, increasing market share, and refining strategies based on the feedback and data gathered during the earlier stages.

Series C Funding: Series C funding occurs when the company is well-established and aims for rapid expansion. Investors in this round may include venture capitalists, private equity firms, and sometimes corporate investors. The funds from Series C are usually deployed for entering new markets, mergers and acquisitions, advanced product development, and overall scaling to become a more dominant player in the industry.

Why is Series A, B, and C Funding Important?

Progressive Growth: The staged funding approach allows startups to secure appropriate funding at different stages of their development, aligning with their growth trajectory.

Risk Mitigation: Investors in each round take on different levels of risk. Series A investors are often more willing to take on higher risks associated with early-stage startups, while Series C investors expect a more mature and stable business.

Strategic Expansion: Each funding round strategically aligns with the company’s goals, providing the necessary resources to achieve specific milestones and navigate challenges associated with each growth phase.

Examples and Usage:

Series A: Used for hiring key talent, developing a minimum viable product (MVP), and initial market penetration.

Series B: Directed towards scaling operations, expanding market reach, and improving the product based on customer feedback.

Series C: Deployed for aggressive market expansion, potential acquisitions, and establishing the company as a market leader.

Key Takeaways:

- Series A, B, and C funding represent different stages of investment in a startup’s growth journey.

- Each round serves a specific purpose, from proving the concept (Series A) to rapid expansion and market dominance (Series C).

- The funding progression aligns with the company’s evolving needs, risk profiles, and strategic objectives.

Table of Contents