Bootstrapping Vs. VC Funding – How to Finance Your Startup in 2023

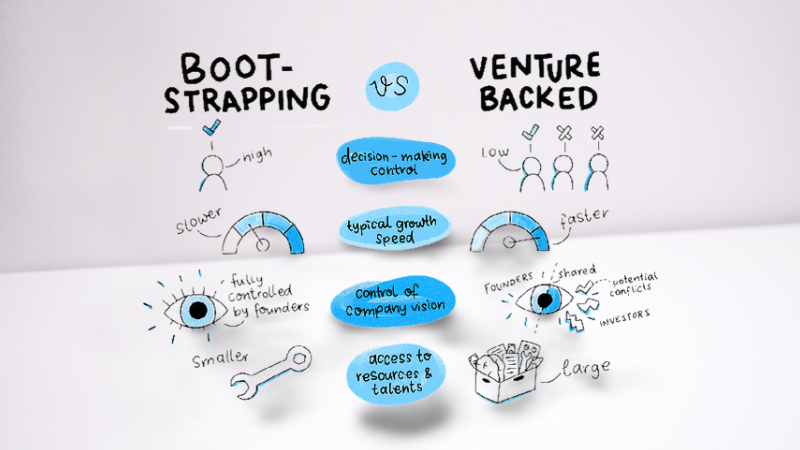

In the first 6 months of 2023 alone, VC firms in the US have raised over $121.5 billion in funds. While this may seem like an attractive figure that would encourage more and more founders to choose the VC funding route for their startups, experts say that the majority of startups, close to 80% utilize bootstrapped resources to fund their businesses. So how do entrepreneurs decide between bootstrapping and VC funding?

Table of Contents

Before we analyze why some founders would choose to bootstrap while others aim to raise VC funding, let us take a brief look at why businesses need sources of financing and what characteristics of your business will determine the type of financing you go for.

1. Why do startups need financing?

This might be too obvious a question to ask but it’s still worth discussing.

There are certain factors to consider when deciding to take the bootstrapping or the VC funding route for your startup.

- What is the ultimate goal of your business?

- Do you plan on exiting at some stage?

- How much risk are you planning on taking with your startup?

- Are you playing in a highly competitive landscape that would require massive rounds of funding?

- What level of control do you prefer to have over your startup?

- How much potential for growth exists within your strategy and your market?

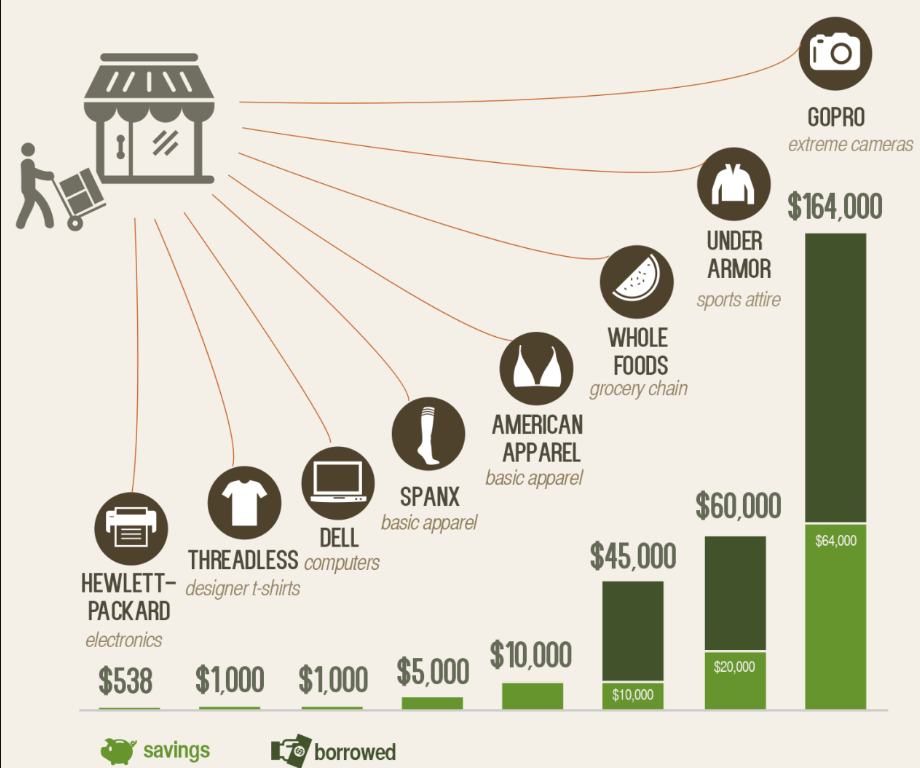

Here’s a look at how some of the biggest companies we know of today started off:

2. What is bootstrapping?

Bootstrapping a company is using your own revenue to grow your business rather than bringing on outside investors. Many large-scale businesses you know of today started off as bootstrapped entities.

It can be pretty appealing to think of building your startup on your own terms with your own money. It is definitely the most sought-after method of building amongst hustlers that are willing to put in the work at all costs. If you manage to pull it off and actually make your bootstrapped business profitable, it can be one of the most rewarding experiences.

Bootstrapping a startup allows you to keep it lean and keep from depending on outside capital. This means your entire growth would be fuelled by internal cash flow generated from the business itself and allows you to have complete control of decisions and how you spend your resources.

3. How to know if you should bootstrap your startup?

In order to ensure bootstrapping is the way to go for your business you may want to look at the following criterion:

You want ownership of your entire business

If you do not want to give up any control and any equity to any other source and if you want to be able to run your own company for its entire existence and decide if and when you want to sell it then bootstrapping may be a good avenue for you. You won’t have anyone looking over your shoulder, asking you questions, or giving advice as is what’s expected if you head the investor route.

You intend to create a small to medium-sized business

Bootstrapping is ideally suited for founders that aim to keep their business and unit economics small. And they generally plan for a slow rate of growth and as there are minimal resources to hire more team members which in turn makes the team a lot more manageable. In most cases, bootstrappers prefer to dominate a niche market than to try and capture a large market share.

You want control over the direction of your business

Most founders do not want to lose their ability to call the shots within their own organization. When external funding comes through investors, it can be very tricky to maintain full authority over the decision-making processes that affect the direction of your business. This is because if you’re to have investors they would have significant influence over the direction of your company. And as they have a stake in your company, you would need to protect their interests in return.

-

It gives you a sense of accomplishment

Entrepreneurs have a sense of pride in building their own products with no outside resources as it is not an easy feat to achieve. As a result, if you were to bootstrap your business and build it into a profitable organization with nothing but your own means, you’re bound to experience a huge sense of accomplishment.

4. Downsides to bootstrapping

Bootstrapping involves no outside debt or investors, but sometimes you have to pull the profits out of the business or have to sell the business to achieve liquidity in the business, and that cash would go back to the founders and initial investors.

5. Things to consider before bootstrapping your startup

If the financial goal for your business does not exceed a few hundred thousand dollars, then bootstrapping is your way to go, as it is very unlikely that VCs would be interested in such small economies of scale.

But make note that bootstrapping would mean you would have to face the following:

- Resource-constrained

- Cannot grow as fast as you want or hire your dream team

- Lack of relationships and connections

- A personal network is extremely vital to bootstrappers

Overall as bootstrappers, you need to focus on increasing your skill sets if you intend on keeping your head above water.

Bootstrapping is not for everyone, especially if you are in an industry that requires research and development, if you’re in pharmaceuticals or medical research, for instance, then bootstrapping is not going to cut it for you

But keep in mind raising VC funding isn’t for everyone either. Not everyone can raise VC funding in the first place.

6. What is Venture Capital Funding?

VC funding is a form of private equity. This type of financing allows investors to seek out businesses, entrepreneurs, and startups that they believe have exponential great potential and invest capital in them. This capital may come in the form of finances or even technical and managerial expertise.

While these investors take huge risks and gamble and switch their investment decisions, they also are aware that some of these companies have the potential to become the next biggest unicorn. Thus they make a gamble based on their expertise and knowledge after taking into consideration future trends.

Raising funding can make things easier. It can make it a little more complicated, but having that bit of extra cash can help out when you have big goals and dreams to achieve.

7. How to know if you should raise VC Funding?

If you plan to raise VC funding for your business, then the following are some of the possible conditions you have set for yourself:

- You aim to build a corporation with a billion-dollar valuation.

- Your startup has high odds of failure and you’re taking a large risk with your business.

- You intend to grow fast at an exponential rate that would require you to have an abundance of funds

If you require huge amounts of capital to even build your business, then VC may be the best route for you to take. Investors can bring in major financial resources that you cannot attain as a bootstrapper. Investors come with connections that help you get in the door which makes it easier to hire the right people as you would have an investor name in tow.

VCs only invest after they’ve witnessed a great product market fit and are sure they have a cash-making machine on their hands.

Venture looks for a high level of growth, which exists in the very early stages of a company.

When you raise a venture, you hire fast, they want you to burn money and raise new funding every 18 months at a higher valuation.

Don’t forget, if you are VC-backed, you would have a board of directors that would need to provide a green light for all your decisions, and relentless board meetings to attend to.

But on the plus side when your company is VC funded, you’re armed with a sense of resilience and security that comes with it. If your company manages to grow exponentially, the VC will invest endless amounts of money to help you do that.

Investors give advice, they provide value that is beyond the monetary value they bring to the company.

As a VC-backed company, you can hire more support, and can move faster, but it can also get a bit more complex, and the funds that come your way come with a lot of expectations.

8. Downsides to VC Funding

- There is a chance that you may end up with an investor that does not see things the way you do, and this can lead to clashes with regard to how the company should be run.

- VC funds have a 10-year duration hence they want the companies to sell or go public within 10 years.

- VCs are at times capable of blocking a sale of your company even if you still own 80 to 90% of the company.

- VCs generally sit on the board of directors with the companies in their portfolios and as such have great decision-making power. In certain cases, they even have the power to oust a founder from his or her own company. Although rare such instances have taken place in the past such as in the case of Elon Musk removing the co-founder of Tesla Martin Eberhard from his own company.

9. Bootstrapping Vs. VC Funding – Do you have to pick one over the other?

Most often this decision is not in black or white. While most startups would begin as self-funded entities while they find their product market fit, they would utilize the revenue gathered from their early adopters to experiment and fine-tune their solutions until they’ve captured a larger segment of their audience.

10. How do you go from bootstrapped to VC Funding?

So you have the right team, your business is making revenue and you have built a solid customer base.

But now you feel it’s time to take it a step further. Maybe your goals have changed since the time you started. Maybe you brought in a new partner that’s got a bigger vision for your company and you too are beginning to see it. But you also know that there’s no way you can achieve that vision with your small bootstrapped budgets.

Now is the time you’d start thinking of external funding.

11. So what should you know before you go and reach out to VCs & how do you prepare for a VC Meeting?

One thing to keep in mind is that it’s not about the solid business plan you got going for your project, nor is it about who you know, or what experience you have in the field. Most VCs won’t care about any of that.

What VCs care about is what you have built, your team, your product, and your customer base.

Do not waste time on networking until you have the MVP & do not waste time on the meetings until you have a product to sell until you have some credibility!

Landing venture capital funding is one of the biggest competitions you would face. Growth at all costs is what VCs are looking for, so if that is something you can prove then you’ve got a good chance of landing one.

12. What is Dilution & when do companies have to go through it?

While in bootstrapped companies founders retain their majority stake, when you work with venture investors, companies end up going through multiple funding rounds, and this is what’s understood as dilution.

Usually, VC-backed companies face around 6 or more rounds of funding with each one buying about 20% of the company which eventually leaves the founders with about 15% stake in their own companies. Dilution is typically resisted by shareholders as it would lead to the devaluation of their existing equity.

13. Things to consider before going the VC route

VCs raise funds from wealthy individuals and firms and invest in startups. But they only care about outlier success. Their entire aim is to invest in high-risk, high-growth companies. Those that go big or go home.

Also, note that VCs not only add funding and value but also provide advice. But their main incentive is to get a return on their investment.

Venture capital may be the route for 1% of businesses while bootstrapping will be for 99% of others.

14. How do VCs make money?

-

Management fee

Some VC firms charge a management fee as they offer more than just funding. Their technical and managerial expertise that’s imparted comes at a price.

-

Carried interest

While other VC firms charge an interest that is carried forward. This is a percentage of the profits that end up going to your fund manager.

15. Alternatives to VC funding

-

Indie funding – angels that don’t have the same level of expectations as ventures, they go for smaller rounds of funding. They have simpler structures, and fewer rules and you do not have to give up control of your business.

-

Non-dilutive funding – this type of investment includes loans, grants, crowdfunding, vouchers, tax credits, licensing, etc. that enable you to fund your startup without relinquishing ownership of your company to external parties. Some platforms like Pipe and iFundWomen offer excellent alternatives for VC funding.

16. How is Angel Investing different from VC Funding?

Unlike venture capitalists that are solely interested in the big bucks, Angel investors take into consideration smaller exits as long as the companies don’t require several rounds of funding. It is often the bootstrapped companies that and in need of small rounds of funding that sought out angel investors in order to help them achieve targets that would be otherwise impossible with their internal finances.

Read More:

Guide to the Top Venture Capital Firms in Boston

Guide to the Top Venture Capital Firms in Miami

Guide to the Top Venture Capital Firms in New Zealand

Guide to the Top Venture Capital Firms in Canda

Guide to the Top Venture Capital Firms in Australia

Hire top vetted developers in LatAms today!