A Complete Overview of the Latin America Software Industry

Table of Contents

Latin America (LATAM) has emerged as a powerhouse in the global software industry, marked by unprecedented growth in recent years. With a collective revenue of $22.1 billion in 2021, countries such as Mexico, Brazil, Colombia, and Argentina have established themselves as hubs for innovative software companies, often rivaling their American counterparts. This surge in the LATAM software sector signifies not only economic prosperity but also technological advancement and entrepreneurial vigor within the region.

Table of Contents

Argentina, for instance, witnessed significant growth with its software market valued at $1.9 billion in 2021, projected to reach $2.8 billion by 2026. Similarly, Brazil, a key player in the region, is poised for substantial growth, with predictions indicating a $6 billion increase in its software market by 2026. Such forecasts underscore the resilience and potential of the LATAM software industry, making it an attractive investment destination for both domestic and international stakeholders.

The proliferation of Software as a Service (SaaS) solutions has been a driving force behind the industry’s expansion. In Brazil, the SaaS market experienced a remarkable surge, reaching $1.5 billion in 2020, with a notable 26% growth compared to the previous year. This growth can be attributed to factors such as increased internet penetration and the widespread adoption of mobile technologies across the region. Additionally, government initiatives aimed at facilitating business establishment have contributed to a favorable environment for software enterprises to flourish.

Venture capital (VC) activity in LATAM has also reached unprecedented levels, with the region boasting 23 unicorns – startups valued at over $1 billion. In 2021, LATAM recorded deals worth $4 billion, marking the second consecutive year of such high investment activity. This surge in VC funding highlights the confidence investors have in the region’s software industry and its potential for further growth and innovation.

Moreover, LATAM’s reputation for producing top-tier software developers has attracted global attention, with a notable increase in companies seeking talent from the region. According to a recent study, interest in hiring from LATAM has surged by 156%, with software engineering being a particularly sought-after skill set. This trend positions LATAM as one of the premier destinations for software outsourcing, offering businesses access to a pool of skilled professionals capable of delivering high-quality solutions.

1. Overview of the LATAM Software Industry

1.1. Early Developments

The emergence of the software industry in Latin America can be traced back to the late 20th century when technological advancements began to sweep across the region. While initially lagging behind more developed nations, Latin American countries started to recognize the potential of software development as a key driver of economic growth and innovation. You can read more about the Latin

During the 1980s and 1990s, several key milestones marked the early developments of the software industry in Latin America. Governments began investing in infrastructure and education, laying the groundwork for a skilled workforce capable of contributing to the burgeoning technology sector. Additionally, the liberalization of economies and the advent of globalization created opportunities for Latin American entrepreneurs to enter the software market and compete on a global scale.

Notable achievements during this period included the establishment of pioneering software companies, often founded by visionary entrepreneurs who saw the potential of technology to transform industries. These companies focused on developing software solutions tailored to the needs of local businesses and government agencies, laying the foundation for future growth and innovation in the sector.

1.2. Evolution and Growth

Over the years, the Latin America software industry has undergone significant evolution and growth, propelled by various factors that have shaped its trajectory

One of the primary drivers of this growth has been the rise of startups and entrepreneurship in the region. Inspired by success stories from around the world, Latin American entrepreneurs have embraced innovation and seized opportunities to disrupt traditional industries. This entrepreneurial spirit has led to the emergence of a vibrant startup ecosystem, with hubs like São Paulo, Buenos Aires, and Bogotá becoming hotbeds of innovation and creativity.

Government support has also played a crucial role in fueling the growth of the software industry in Latin America. Recognizing the strategic importance of technology for economic development, governments across the region have implemented policies and programs to incentivize investment in the sector. These initiatives include financial incentives, tax breaks, and initiatives to foster collaboration between industry stakeholders.

Moreover, the region’s abundant tech talent has been instrumental in driving innovation and growth in the software industry. Latin America boasts a skilled workforce of software developers, engineers, and designers, many of whom have been educated at top universities and technical institutes. The availability of talent has attracted investment from multinational companies and venture capital firms, further fueling the expansion of the industry.

Additionally, nearshoring and outsourcing have emerged as popular strategies for businesses seeking to leverage the expertise of Latin American software developers. The region’s proximity to major markets, cultural affinity with Western countries, and competitive labor costs make it an attractive destination for outsourcing software development projects.

2. Market Size and Growth of LATAM Software Industry

2.1. Current Market Size

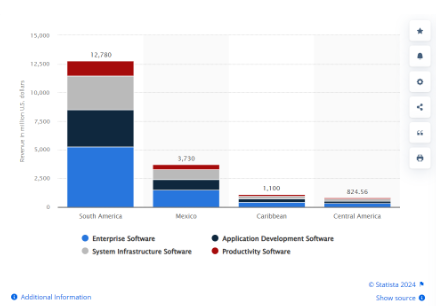

The Latin America software industry has emerged as a significant player in the global market, characterized by substantial revenue generation and widespread adoption of software solutions across various sectors. According to statistics on Statista.com, the software industry witnessed robust growth in 2022, with total revenue reaching $18.6 billion USD, highlighting its increasing importance in the regional economy.

Within the Latin American software landscape, the enterprise software segment stands out, accounting for nearly 40% of the market. This segment encompasses a wide range of business-oriented tools aimed at enhancing productivity, efficiency, and operational effectiveness across organizations. Notably, the productivity software sector contributed significantly to the industry’s revenue, totaling approximately $2.1 billion USD in 2023.

Office software, a key component of productivity software, emerged as a valuable segment within the Latin American market, offering features such as real-time collaboration, security, and seamless application updates. The revenue generated from office software in 2023 underscores the growing reliance on digital tools to streamline work processes and facilitate team collaboration in the region.

-

Growth Trends and Projections

Looking ahead, the Latin America software industry is poised for significant expansion, driven by several key factors and favorable market dynamics. Projections indicate a promising trajectory for the industry, with robust growth expected in the coming years.

Argentina’s software market, for instance, was valued at $650.8 million USD in 2021, with expectations to surpass $915 million USD by 2028. Similarly, Brazil, a major player in the region, is forecasted to experience substantial growth, with the software market projected to increase by over $3 billion USD from 2023 to 2028. The Latin American Outsourcing industry is growing at rapid speed. Read what CloudDevs says about outsourcing in Latin America.

Several factors contribute to the optimistic outlook for the Latin America software industry. Firstly, the region is witnessing rapid expansion in mobile technology and internet usage, driving demand for software solutions across various sectors. This trend reflects a growing digital economy and an increasing reliance on technology to drive innovation and competitiveness.

Moreover, governments across Latin America have implemented measures to facilitate business growth and attract foreign investment, creating a conducive environment for the expansion of the software industry. Initiatives aimed at streamlining regulatory processes and promoting entrepreneurship have contributed to a thriving ecosystem for software development and innovation.

Latin America boasts a significant pool of tech talent, providing a competitive advantage over other regions grappling with skills shortages. The availability of skilled professionals, coupled with ongoing efforts to bridge skills gaps through education and training programs, positions Latin America as a prime destination for software development and innovation.

The Latin America software industry is poised for continued growth and expansion, driven by technological advancement, supportive government policies, and a robust talent pool. With promising growth prospects and increasing market demand, the region holds significant potential to emerge as a global leader in the software market in the years to come.

3. Regional Analysis of Latin America Software Industry

3.1. Argentina

– Population: 45 Million

– Economy: 2nd largest in LATAM

– Languages: Spanish and English (highest proficiency in LATAM)

– Unicorns: 11

– Number of developers: 115,000

– Average senior software developer annual salary: $56,000

Argentina’s software development market has been rapidly evolving, propelled by its robust infrastructure and a thriving ecosystem of approximately 3,800 local IT companies. This burgeoning market has positioned Argentina as a prime outsourcing destination, particularly favored by U.S. companies seeking near-shoring solutions due to factors such as high English proficiency, competitive rates, and favorable time zones.

The country’s software development market is poised for significant growth, with projected revenues expected to reach $2.7 billion within the next five years. Notably, the United States constitutes the largest market for Argentina’s outsourcing services, accounting for approximately 60% of the country’s IT sector growth.

IT companies in Argentina offer a diverse range of services, including custom software development, IT consulting, and mobile app development, catering to various industries such as IT, finance, and eCommerce.

3.2. Brazil

– Population: 212 Million

– Unicorns: 20

– Number of developers: 500,000

– Software development outsourcing: Ranked 13th country globally

– Languages: Portuguese, English (intermediate proficiency)

Brazil stands out as a leading destination for software development outsourcing, offering a vast pool of over 500,000 developers and approximately 25,000 IT companies. Renowned for its fair developer rates and high-education standards, Brazil has garnered attention from U.S.-based startups interested in outsourcing software development projects or recruiting talent from the region.

The country’s IT development market is valued at $49.5 million, representing the largest share of the entire LATAM’s IT outsourcing market. With over 6,400 companies specializing in custom software development, Brazil serves industries such as eCommerce, Telecom, Finance, and IoT. Notable companies outsourcing IT projects to Brazil include Amazon, Dell, Google, and Meta.

3.3. Mexico

– Population: 128 million

– Number of developers: 220,000 (ranked second in LATAM for best developers and programmers)

– Unicorns: 7

– Languages: Spanish and English (intermediate proficiency)

– Average senior software developer annual salary: Approx. $49,959

Mexico has established itself as a prominent source of IT professionals for U.S.-based organizations, boasting a diverse and skilled workforce of 220,000 developers. With its close geographical proximity, favorable time zone, and conducive business environment, Mexico attracts significant investment in its IT sector, generating revenue worth $60 billion, primarily from product development and IT services.

The country’s burgeoning startup scene, which generated $3.38 billion in 2021, reflects its growing reputation as a hub for innovation and entrepreneurship. IT outsourcing in Mexico focuses on Telecom services, Finance projects, and Consumer Products and Services, with major tech companies such as Amazon, Google, Microsoft, and Netflix outsourcing to the region.

3.4. Chile

– Population: 19 million

– Number of developers: 61,000

– Unicorns: 1

– Languages: Spanish, English (intermediate proficiency)

– Average senior software developer annual salary: Approx. $37,500

Chile boasts one of the strongest skills proficiency in software development across Latin America, with a growing IT scene centered around Santiago, the capital. The country’s startup culture and commitment to innovation have positioned it as a major tech hub in the region, with expertise spanning fields such as data processing, web development, and green technology.

Chile’s favorable business environment, characterized by high economic freedom and bilateral trade agreements, has attracted multinational companies such as GE, Oracle, Synopsys, and Yahoo. The country’s emphasis on entrepreneurship and innovation underscores its potential as a leading destination for software development and technology investment.

3.5. Colombia

– Population: 51 Million

– ?Number of developers: 150,000

– ?Unicorns: 3

– ?Languages: Spanish, English (low proficiency)

– ?Average senior software developer annual salary: Approx. $59,993

Colombia, despite being in a relatively lower state of development compared to other countries in the region, boasts a significant population of trained software developers and a thriving startup ecosystem. The country’s abundance of skilled labor, coupled with its openness to investment and flexible labor policies, has made it an attractive destination for IT outsourcing and talent recruitment.

Colombian software development company PSL has garnered recognition as one of the best in Latin America, with a team of over 600 professionals operating across multiple cities in Colombia. With its competitive advantages and growing reputation in the tech industry, Colombia is poised to play a significant role in the region’s software development landscape.

4. Advantages of Hiring Developers from Latin America Software Industry

The Latin America software industry has witnessed exponential growth in recent years, positioning itself as a viable destination for outsourcing software development. Hiring developers from LATAM offers several advantages that can significantly benefit startups seeking expert technical talent. Read the reasons why you should consider hiring LATAM Developers in 2024 by CloudDevs.

- Expert Software Developer Services

LATAM has become a hotspot for tech investment, fostering the growth of a vibrant tech ecosystem. Renowned tech giants and startups alike are increasingly outsourcing IT projects to LATAM, highlighting the region’s prowess in IT and software engineering. Major players like Amazon, Airbnb, Google, and Netflix have established a presence in countries such as Brazil, further bolstering LATAM’s reputation as a hub for top-notch developer services.

- Cost-Effectiveness

While LATAM software developers may command higher rates compared to some offshore destinations, they remain significantly more affordable than their North American counterparts. Leveraging staff augmentation can enable startups to reduce costs associated with full-time positions, including salaries, benefits, and additional perks. This cost-effective approach allows startups to allocate resources efficiently while accessing high-quality developer talent.

- English Proficiency

LATAM countries boast increasingly proficient English skills, surpassing many other outsourcing regions globally. For instance, Argentina ranks among the top LATAM countries with “high proficiency” in English competencies. Improved English proficiency facilitates seamless communication between remote teams and clients, minimizing misunderstandings and enhancing collaboration on software development projects.

- Minimal Time Zone Differences

Unlike regions with substantial time zone disparities, most LATAM countries maintain minimal time differences from the U.S., typically ranging from 1 to 3 hours. This close alignment simplifies communication and coordination between teams, ensuring efficient project management and timely responses to queries or issues. The reduced time zone differences contribute to smoother workflow and enhanced productivity.

- Proximity to the U.S.

Geographical proximity to the U.S. offers logistical advantages for businesses outsourcing to LATAM. Closer proximity facilitates easier travel arrangements, allowing companies to visit remote teams, participate in development cycles, and foster stronger relationships with developers. This physical proximity enhances cultural alignment and team building, fostering collaboration and cohesion within remote teams.

- Cultural Compatibility

Despite distinct cultural differences, there are notable similarities between North American and Latin American cultures. Shared values such as a strong work ethic and belief in individual potential contribute to cultural compatibility and alignment. Additionally, similarities in media consumption, brand preferences, and working standards promote synergy and collaboration between teams, reducing the likelihood of cultural clashes and enhancing overall project outcomes.

Hiring developers from the LATAM software industry offers numerous benefits, including access to expert talent, cost-effectiveness, enhanced communication, minimal time zone differences, proximity to the U.S., and cultural compatibility. By leveraging these advantages, startups can drive innovation, accelerate project timelines, and achieve sustainable growth in today’s competitive market landscape.

5. Future Outlook of the Latin America Software Industry

5.1. Emerging Technologies

The Latin America software industry stands at the brink of transformation, fueled by the emergence of cutting-edge technologies poised to redefine its landscape. Among these technologies, artificial intelligence (AI), blockchain, and Internet of Things (IoT) hold immense potential to revolutionize software development processes and solutions.

- Artificial Intelligence (AI)

AI is expected to play a pivotal role in reshaping the Latin America software industry by enabling intelligent automation, predictive analytics, and personalized user experiences. With AI-driven solutions, businesses can streamline operations, optimize resource allocation, and deliver innovative products and services tailored to meet evolving consumer demands.

- Blockchain Technology

Blockchain technology offers unprecedented opportunities for enhancing security, transparency, and efficiency in software applications across various industries. In Latin America, blockchain solutions are poised to transform areas such as supply chain management, financial services, and identity verification, fostering trust and reliability in digital transactions.

- Internet of Things (IoT)

The proliferation of IoT devices presents new avenues for software innovation in Latin America. By connecting devices and leveraging data analytics, IoT solutions can unlock efficiencies, improve decision-making processes, and drive digital transformation across sectors such as manufacturing, healthcare, and smart cities.

5.2. Market Potential

Latin America’s software market holds immense untapped potential, driven by factors such as increasing mobile technology adoption, favorable government policies, and a skilled tech workforce. The region presents lucrative growth opportunities in diverse sectors, including fintech, e-commerce, healthcare, and agriculture.

- Fintech

The fintech sector in Latin America is poised for significant expansion, fueled by rising demand for digital financial services and innovative payment solutions. With a growing population of tech-savvy consumers and supportive regulatory frameworks, fintech startups can thrive in this burgeoning market.

- E-commerce

E-commerce is experiencing rapid growth in Latin America, driven by factors such as rising internet penetration, changing consumer preferences, and the proliferation of mobile devices. As e-commerce platforms continue to evolve and cater to diverse market segments, there is ample opportunity for software developers to create innovative solutions that enhance the online shopping experience.

- Healthcare

The healthcare sector presents immense potential for software innovation in Latin America, particularly in areas such as telemedicine, electronic health records, and remote patient monitoring. With an increasing focus on digital health solutions and improving access to healthcare services, software developers can play a crucial role in driving innovation and improving health outcomes across the region.

5.3 Industry Collaboration and Partnerships

Collaboration and partnerships will be key drivers of success for the Latin America software industry in the future. By fostering strategic alliances and leveraging collective expertise, industry players can accelerate innovation, mitigate risks, and capitalize on emerging opportunities.

- Cross-Sector Collaboration

Collaboration between software companies and other industries, such as finance, healthcare, and agriculture, can lead to the development of integrated solutions that address complex challenges and deliver greater value to customers. By combining domain knowledge with technological expertise, collaborative efforts can drive digital transformation and foster sustainable growth.

- Public-Private Partnerships

Public-private partnerships play a crucial role in driving innovation and infrastructure development in Latin America. By collaborating with government agencies, software companies can access funding, regulatory support, and market insights to navigate complex challenges and expand their reach. These partnerships can facilitate the adoption of emerging technologies and accelerate the digitalization of key sectors, driving economic growth and social development.

The future outlook for the Latin America software industry is promising, with emerging technologies, untapped market opportunities, and industry collaboration poised to drive innovation and growth across the region. By embracing these trends and fostering strategic partnerships, stakeholders can unlock the full potential of the Latin America software ecosystem and shape a brighter future for the industry.

6. Conclusion

In conclusion, the Latin America software industry is undergoing rapid growth, driven by technological advancement, entrepreneurial vigor, and supportive market conditions. With impressive revenue figures and the emergence of numerous tech startups and unicorns, the region is becoming increasingly significant in the global market. Key factors such as skilled tech talent, improving English proficiency, and cost-effectiveness make Latin America an attractive destination for outsourcing software development.

If you are searching for a dependable platform to hire remote software developers and tech experts in LATAM countries, CloudDevs is your optimal solution. As one of the premier talent platforms with over 8000+ developers and designers across Latin America, CloudDevs aids its clients in expanding their IT teams and recruiting exceptionally skilled software professionals in 24 hours.

Looking ahead, emerging technologies and untapped market opportunities promise continued growth and success for the industry. Overall, the future prospects for the Latin America software industry are bright, with ample potential for further expansion and innovation.