Debt-to-Equity Ratio

What is Debt-to-Equity Ratio?

Definition:

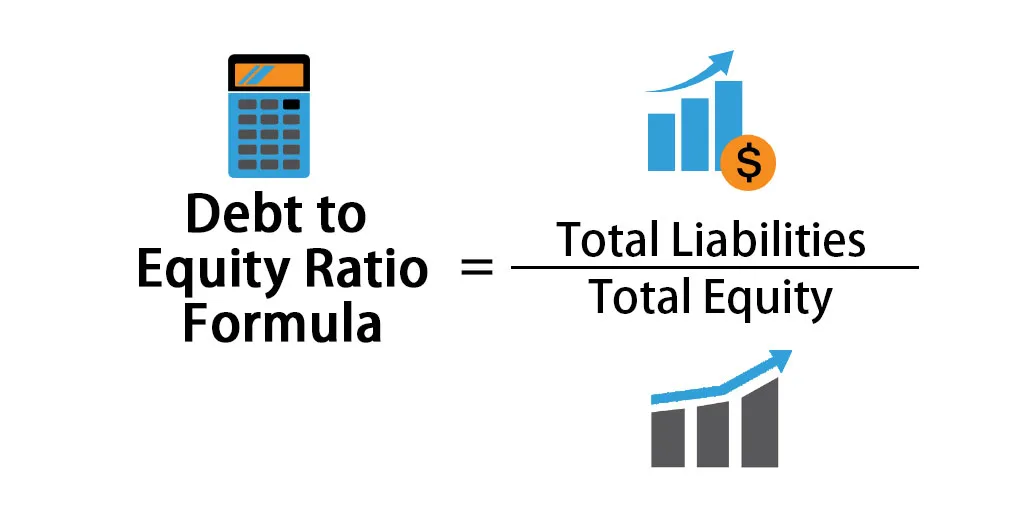

“Debt-to-Equity Ratio” is a financial metric that represents the proportion of a company’s financing that comes from debt compared to equity. It is calculated by dividing the total debt of a company by its total equity. This ratio provides insights into the capital structure of a business, indicating the extent to which it relies on debt financing versus equity financing.

Formula: Debt-to-Equity Ratio = Total Equity/Total Debt

?

Analogy:

Think of Debt-to-Equity Ratio as a seesaw. On one side, you have the company’s debt, and on the other, you have its equity. The ratio represents the balance between the two, indicating whether the company is more leveraged with debt or has a higher equity stake.

Further Description:

- Total Debt: This includes all forms of debt a company owes, such as loans, bonds, and other financial obligations.

- Total Equity: This is the residual interest in the assets of the company after deducting its liabilities. It represents shareholders’ equity.

Why is Debt-to-Equity Ratio Important?

- Risk Assessment: Indicates the risk associated with a company’s capital structure. Higher debt ratios may suggest higher financial risk.

- Financial Health: Provides insights into the financial health and stability of a company, especially its ability to meet debt obligations.

- Investor Confidence: Influences investor confidence by signaling how the company has chosen to finance its operations and growth.

Examples and Usage:

- High Debt-to-Equity Ratio: A ratio above 1 indicates that the company has more debt than equity, potentially signaling higher financial risk.

- Low Debt-to-Equity Ratio: A ratio below 1 suggests a more conservative capital structure, with less reliance on debt financing.

- Industry Comparison: Comparing the ratio with industry averages helps assess whether the company’s capital structure is in line with peers.

In summary, Debt-to-Equity Ratio is a key financial metric that provides insights into a company’s capital structure, risk profile, and financial health.

Key Takeaways:

- Debt-to-Equity Ratio is the proportion of a company’s financing that comes from debt compared to equity.

- Calculated by dividing total debt by total equity.

- Used for risk assessment, evaluating financial health, and influencing investor confidence.

- A ratio above 1 indicates higher debt reliance, while below 1 suggests a more conservative capital structure.