Early-Stage Funding

What is Early Stage Funding?

Definition:

Early Stage Funding in the context of computing and technology refers to the initial financial support provided to startups and emerging companies that are in their early development phases. This funding is crucial for turning innovative ideas into viable products or services. It includes financial backing for research, product development, market analysis, and initial business operations.

Analogy:

Think of early stage funding as the seed money required to nurture and grow a young plant. Just as a seed needs water, sunlight, and nutrients to sprout and develop into a mature plant, early stage funding provides the essential resources for budding tech companies to flourish and establish a strong foundation.

Further Description:

Early stage funding in computing and technology encompasses several key components:

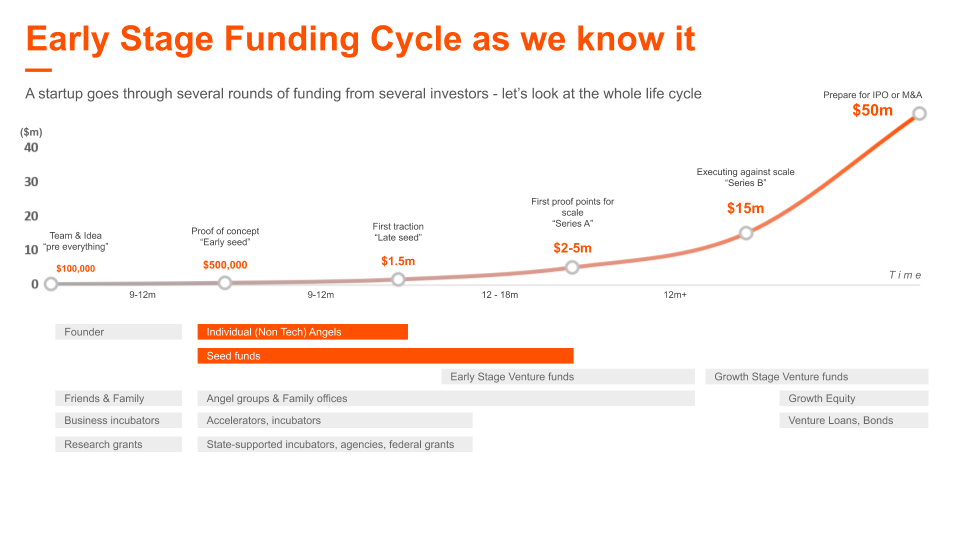

Seed Funding: Seed funding is the initial capital injection that helps startups conduct research, develop prototypes, and validate their ideas. It usually comes from angel investors, friends and family, or earlystage venture capital firms.

Product Development: Funding is allocated to develop and refine the core product or technology. This stage involves coding, testing, and iterating to create a minimum viable product (MVP) that can be presented to potential users and investors.

Market Analysis: Financial support is provided for market research and analysis to understand the target audience, competition, and potential market trends. This information guides startups in refining their productmarket fit.

Team Building: Early stage funding allows companies to attract and retain key talent. This includes hiring skilled professionals in software development, engineering, and other crucial roles.

Prototyping and Testing: Tech startups use early funding to create prototypes and conduct testing. This phase helps identify and rectify potential flaws or areas for improvement in the product.

Business Operations: Funding supports daytoday operations, covering expenses such as office space, utilities, legal fees, and other overhead costs.

Why is Early Stage Funding Important?

Innovation Boost: Early stage funding fosters innovation by providing the necessary resources for turning groundbreaking ideas into tangible products or services.

Risk Mitigation: Startups face high risks during their initial stages. Early stage funding helps mitigate these risks by providing a financial buffer to navigate challenges and uncertainties.

Competitive Edge: Companies that secure early stage funding can gain a competitive edge by accelerating their product development and market entry, positioning themselves ahead of potential competitors.

Talent Attraction: Adequate funding allows startups to attract and retain toptier talent, creating a skilled and dedicated team to drive the company’s success.

Proof of Concept: Early funding enables startups to build a proof of concept, demonstrating the viability and potential success of their technology or solution to attract further investment.

Examples and Usage:

Tesla: In its early stages, Tesla Motors secured funding to develop the Tesla Roadster, the company’s first electric car. This early investment played a crucial role in establishing Tesla as a major player in the electric vehicle market.

Facebook: Mark Zuckerberg received early stage funding from angel investors like Peter Thiel, allowing him to transform Facebook from a college project into the social media giant it is today.

SpaceX: Elon Musk’s SpaceX received early stage funding to develop the Falcon 1 rocket. This initial investment laid the foundation for SpaceX’s subsequent achievements in the aerospace industry.

Key Takeaways:

- Seed funding is the initial capital injection for startups, supporting research, product development, and market analysis.

- It plays a crucial role in fostering innovation and mitigating risks during the early stages of a tech company.

- Early funding is instrumental in attracting talent, building prototypes, and establishing a competitive edge in the market.

- Investors often provide early stage funding to startups with promising ideas and potential for growth.