Financial Modeling

What is Financial Modeling?

Definition:

“Financial Modeling” is a method of creating a numerical representation or simulation of a financial situation or decision. It involves building a mathematical model that captures the key aspects of a business’s financial performance, allowing for analysis, forecasting, and informed decision-making. Financial models can vary in complexity and purpose, ranging from simple budgeting models to sophisticated valuation models for investment analysis.

Analogy:

Think of Financial Modeling as a roadmap. Similar to a roadmap guiding travelers with detailed directions, landmarks, and estimated travel times, financial models provide a detailed path for understanding and predicting a company’s financial journey.

Further Description:

Components of Financial Modeling:

- Assumptions: Key variables and estimates that form the basis of the model.

- Income Statement, Balance Sheet, and Cash Flow Statement: Core financial statements integrated into the model.

- Formulas and Calculations: Mathematical relationships representing business operations, growth rates, and financial metrics.

- Scenario Analysis: Examination of various scenarios and their impact on financial outcomes.

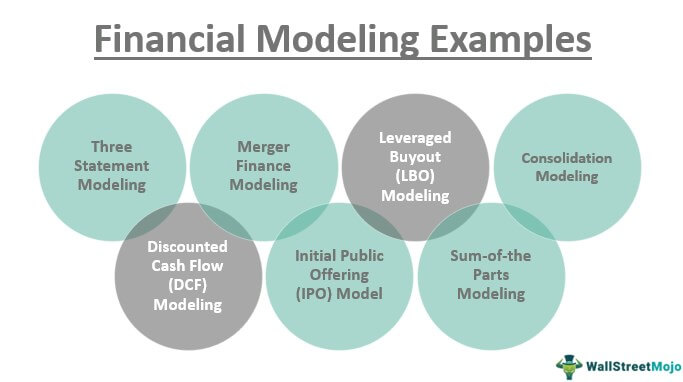

Types of Financial Models:

- Budgeting Models: Plan and track financial goals and expenditures.

- Valuation Models: Evaluate the worth of an investment, company, or asset.

- Forecasting Models: Project future financial performance based on historical data and assumptions.

Applications in Business:

- Strategic Planning: Financial models help businesses plan for growth, mergers, or market expansion.

- Investment Analysis: Investors use models to assess the potential return and risk of an investment.

- Startup Funding: Startups use financial models to present projections and secure funding.

Why is Financial Modeling Important?

Informed Decision-Making:

Financial models provide insights that aid decision-makers in understanding the financial implications of various choices.

Risk Management:

Scenario analysis within financial models allows businesses to assess and mitigate potential risks.

Strategic Planning:

Financial models are essential for long-term strategic planning and goal setting.

Examples and Usage:

Company Valuation:

Financial analysts use discounted cash flow (DCF) models to estimate the intrinsic value of a company.

Project Finance:

Financial modeling helps assess the financial viability of large projects, such as infrastructure developments or real estate ventures.

Mergers and Acquisitions:

In M&A transactions, financial models are used to evaluate the impact of the merger on the financial performance of the combined entity.

In summary, Financial Modeling is a powerful tool for creating a numerical representation of a company’s financial situation. It aids in decision-making, risk management, and strategic planning, making it a fundamental practice in finance and business.

Key Takeaways:

- Financial Modeling involves creating a numerical representation of a financial situation or decision.

- It includes key components like assumptions, financial statements, formulas, and scenario analyses.

- Financial models are crucial for informed decision-making, risk management, and strategic planning.