Go Public (IPO)

What is Go Public (IPO)?

Definition:

Initial Public Offering (IPO) refers to the process of a private company becoming a publicly traded entity by offering its shares to the public for the first time. It is a significant milestone for a company, marking its transition from private ownership to public ownership. The IPO process involves various steps, regulatory compliance, and financial considerations, and it plays a crucial role in raising capital, increasing visibility, and providing liquidity to existing shareholders.

Analogy:

Think of an IPO as a private company opening its doors to the public for investment, similar to a grand opening event for a store. The company, once accessible to a limited group of investors, now welcomes a broader audience of potential shareholders through the stock market.

Further Description:

IPO involves several key components and steps:

Decision and Preparation: The company’s leadership decides to go public, considering factors such as growth opportunities, capital requirements, and the desire for liquidity. The company then prepares financial statements, conducts audits, and ensures compliance with regulatory requirements.

Underwriting: The company partners with investment banks that act as underwriters. Underwriters help determine the IPO price, purchase shares from the company, and sell them to the public. They also facilitate the entire IPO process, including regulatory filings.

Regulatory Compliance: The company must adhere to regulatory requirements set by the Securities and Exchange Commission (SEC) and other relevant authorities. This includes submitting a registration statement, providing financial disclosures, and obtaining regulatory approvals.

Roadshow: The company conducts a roadshow, where its executives and underwriters present the investment opportunity to potential institutional investors. This helps generate interest and determine the IPO price.

Pricing and Allotment: The IPO price is set based on investor demand during the roadshow. The underwriters allocate shares to institutional investors, retail investors, and other stakeholders.

Market Debut: The company’s shares are listed on a stock exchange, and trading begins. The stock’s performance on the first day is closely watched, and it often reflects market sentiment and demand for the company’s shares.

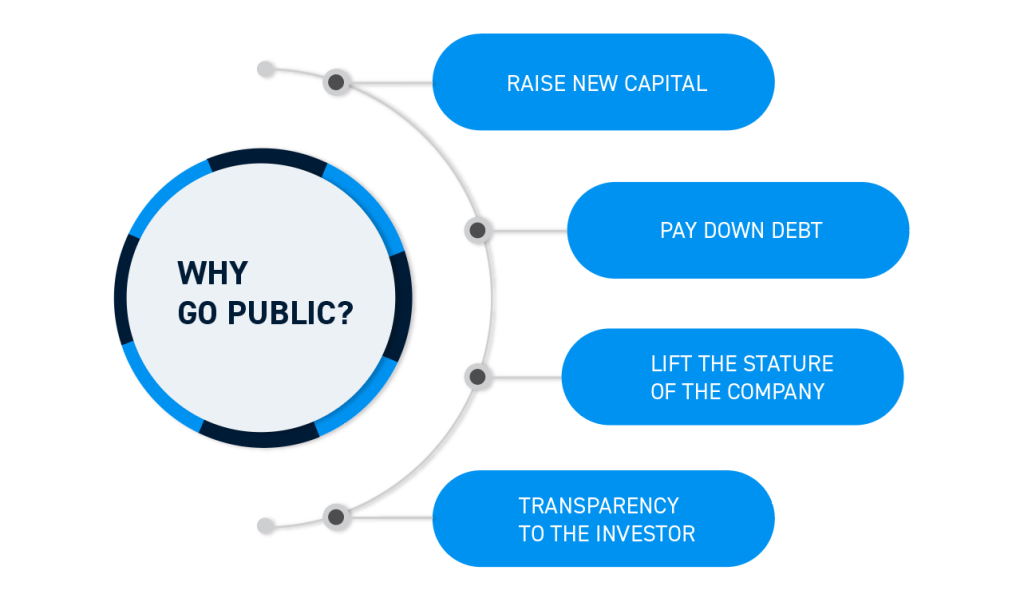

Why is Going Public (IPO) Important?

Capital Infusion: Going public allows companies to raise capital by selling shares to a wide range of investors, providing funds for expansion, research and development, debt reduction, or other corporate initiatives.

Liquidity for Shareholders: Existing shareholders, including founders and early investors, can monetize their investments by selling shares in the public market, providing liquidity.

Enhanced Visibility and Prestige: A public listing increases a company’s visibility, credibility, and prestige. It can attract attention from customers, partners, and the media.

Employee Benefits: Stock options and equity-based compensation become more valuable and meaningful for employees. Going public can also help attract top talent.

Mergers and Acquisitions: Publicly traded companies often use their stock as a currency for mergers and acquisitions, facilitating growth and market consolidation.

Examples and Usage:

Facebook (Meta Platforms, Inc.): Facebook went public in 2012, raising over $16 billion in one of the largest IPOs in history. The IPO provided liquidity to early investors and allowed the company to invest in strategic initiatives.

Alibaba Group: Alibaba, the Chinese e-commerce giant, went public on the New York Stock Exchange in 2014, raising $25 billion. The IPO was significant in the global financial markets and marked Alibaba’s expansion.

Snowflake Inc.: Snowflake, a cloud data platform, went public in 2020 in one of the largest software IPOs. The company’s shares surged on the first day of trading, reflecting strong investor demand.

Key Takeaways:

- IPOs provide an opportunity for companies to raise capital by selling shares to the public, facilitating growth, and supporting strategic initiatives.

- Liquidity for Shareholders: Going public allows existing shareholders to monetize their investments by selling shares on the public market, providing liquidity and an exit strategy.

- Public listings increase a company’s visibility, credibility, and prestige, attracting attention from customers, partners, and the media.

- Public companies can offer stock options and equity-based compensation, making it more attractive to recruit and retain top talent.

- Publicly traded companies can use their stock as a currency for mergers and acquisitions, contributing to market consolidation and expansion.