Investment Round

What is Investment Rounds

Definition:

An “Investment Round” in the realm of entrepreneurship refers to a phase in a startup’s lifecycle during which it seeks external funding from investors to fuel its growth and expansion. Investment rounds typically involve the issuance of equity or convertible debt in exchange for capital injection from venture capitalists, angel investors, or other institutional investors. These funds are crucial for startups to scale their operations, develop new products, expand their market reach, and achieve strategic objectives.

Analogy:

Think of an Investment Round as a fuel refill station for a long journey. Just as a vehicle requires periodic refueling to sustain its journey, startups require investment rounds to replenish their financial resources and propel their growth trajectory forward.

Further Description:

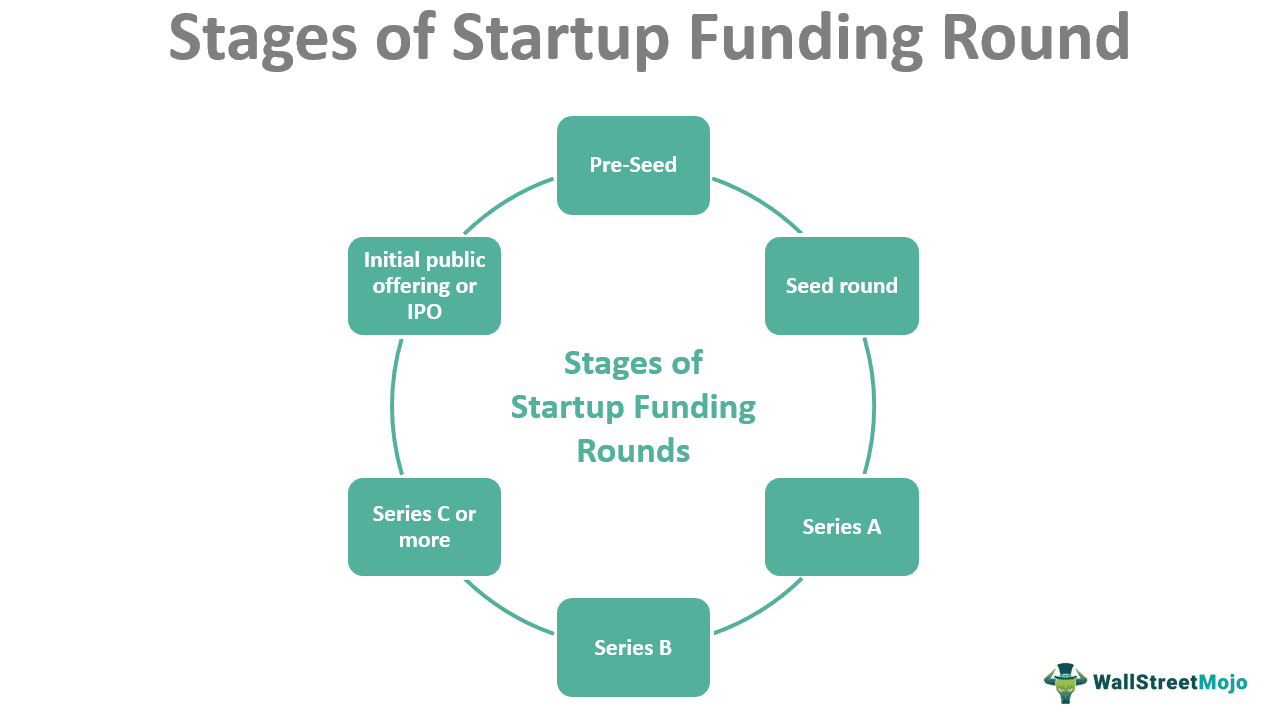

Investment Rounds serve as pivotal milestones in a startup’s evolution and are typically categorized into various stages, including seed rounds, Series A, Series B, and so forth. Each investment round represents a different stage of growth and maturity for the startup, with corresponding investor expectations, valuation, and funding requirements.

Why is an Investment Round Important?

Investment rounds provide startups with the necessary capital to accelerate their growth, execute their business strategies, and achieve key milestones. External funding not only provides financial resources but also brings strategic expertise, industry networks, and credibility to the startup, enhancing its ability to attract customers, talent, and future investors.

Examples and Usage:

Seed Round: Startups often raise seed rounds to validate their business idea, develop a minimum viable product (MVP), and conduct initial market testing.

Series A: Series A rounds typically follow seed rounds and are aimed at scaling the startup’s operations, expanding its customer base, and refining its product-market fit.

Series B and Beyond: Subsequent investment rounds, such as Series B and beyond, focus on further scaling the startup, penetrating new markets, and achieving profitability or liquidity events.

Key Takeaways:

- Investment Rounds are crucial stages in a startup’s journey where external investors provide capital in exchange for equity or convertible debt.

- These rounds enable startups to accelerate their growth, execute their business strategies, and achieve key milestones.

- Investment rounds are categorized into various stages, each representing a different level of maturity and funding requirements for the startup.

- External funding not only provides financial resources but also brings strategic expertise, industry networks, and credibility to the startup, enhancing its growth potential.

Table of Contents